In the past, many people thought that checking their credit reports was unnecessary or unimportant, but as more and more of us realize just how important good credit can be, it has become very clear that checking your credit report regularly is vital to your financial well-being. Here are some reasons why checking your credit report is so important, and why you should make sure you’re doing it regularly.

1: What Is a Credit Report?

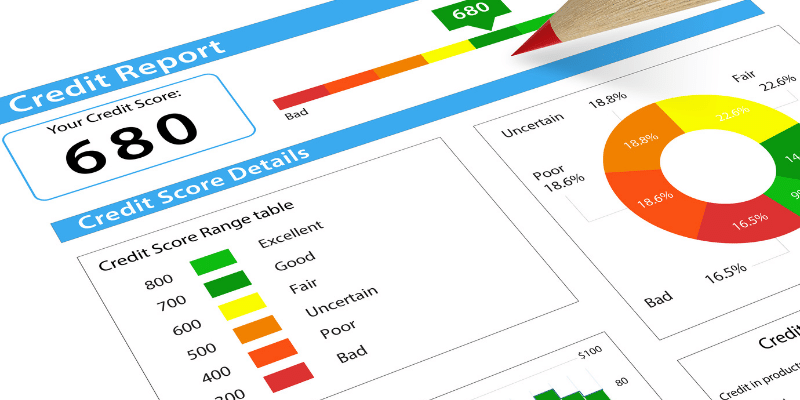

A credit report is a detailed account of your financial history and behaviour. All the major credit reporting agency will have your information on file. When you apply for loans, mortgages, or credit cards, the lender will request your credit report to help them decide whether or not to approve your application. Having a bad credit report can make it difficult or impossible to get financing for a house or car. You should check your credit report as often as possible to make sure everything is accurate and up-to-date so that you know when lenders are checking up on you.

2: What Does Your Report Contain?

3: How Often Should You Check Your Credit Report?

4: How Can You Get Your Free Report?

You can request your report by visiting their websites or calling their toll-free number. It’s important to check your report at least once a year to make sure there are no errors that could be affecting your credit score. What’s more, if you see something on your report that isn’t true, you have the right to dispute it and get it removed immediately. A credit reporting agency is required by law to investigate any disputes that happen within 30 days of being reported. If they find out you’re right, they’ll delete the disputed item; otherwise, they’ll notify the other two agencies about the inaccuracy and let them decide what needs to happen next.

5: Your Credit May Be Affected by Others’ Mistakes.